Pondering The Broader Market: An Equity Analyst's Take on Swiss Watch Exports

Disclaimer: I do run a hedge fund and may at any time have a position in or against any company mentioned here, though I have no intention of doing so any time soon. That said, this should not be construed as investment advice of any sort. If you wager money based on any of the drivel I spew, you deserve exactly what's coming to you.

Also a completely shameless plug: Donate $25 to the charity of your choice and enter to win a Jack Mason Strat-o-Timer!

The Federation of Swiss Watch Industry just issued their monthly stat dump on Swiss watch exports and in a word, it's ugly.

Swiss watch exports declined in value by 16% in March and 25% in units, on the heels of a 4% (5% by value) decline in February.

Part of this is seasonal. Easter fell early this year, of course, which probably had some impact in US and European markets....but the real kicker is in the details. China and Hong Kong demand fell by 40%+.

But there's no way around it, this is an absolutely godawful performance. Frankly, I can't remember performance as bad as this on a monthly basis since the big corruption crackdowns in China in 2012 following the CCP National Congress.

Unlike in prior months, the declines were widespread across regions and price points. Watches under 500 CHF fell by 11% (19% in units) in the month, lapping the boost from the introduction of the MoonSwatch in March of 2022 and the rapid growth in 2023. To some degree, a decline off the sugar high was inevitable.

More interestingly, watches priced between 500 and 3000 CHF fell by over 38% (42% in units) globally in March on the back of a 12% decline in February (14% in units). Some thoughts on this later

Most tellingly, watches priced above 3000 CHF, historically a refuge, declined by 10% in value (16% in units). The higher end consumer is beginning to pull back a touch (though perhaps not the ultra high end, an area I don't have great data on).

The air is leaking rapidly from the watch bubble.

Why is this happening?

I'm not paid nearly enough to actually venture anything but unsubstantiated opinions, but here goes.

Economic volatility. As an American, our economy is bumping along okay, but it's definitely not the case in the rest of the world. The former engines of luxury demand are beginning to tail off as economic growth disappoints.

Remember that massive decline in the 500-3000 CHF tier? I suspect, that the buyers of mid tier watches are trading down into the lower tier (supporting the lowest price points) and the buyers of higher price point watches are likely benefiting from buzzy stock markets and that wealth effect. The middle gets squeezed.

The bullwhip effect. During times of more demand than supply, ADs increased their ordering dramatically from their suppliers in order to attempt to satisfy their immediate demands. Those increased inventories are now hitting just as demand is softening. What is an AD to do now? Order less and the brands feel it instead

A lot of brands overstretched their pricing power by a lot with luxury hungry buyers during COVID. What happens when the ability and willingness to buy goes down.

So what does this all mean?

No one working in watches is happy right now, but some people are much less happy than others.

We won't get any financial data from Rolex, Patek, or any of the independents of course, but the publicly traded conglomerates are beginning to report.

In Q1, LVMH reported a decline of 2% organically on its mostly higher end portfolio and suggests this is going to be a negative year for them.

If I had to guess, LVMH is probably taking it in the chin in brands like Tag (with its heavy reliance on the Formula 1 line) and watch demand for Bulgari, Hublot, and Zenith is holding up okay (just because of a higher end customer).

Maybe the LVMH CFO said it best in response to a questions about underlying demand,

"As far as watches are concerned, Well the --- I confirm we are not particularly optimistic. I mean, we don't expect a catastrophe but the messages we got from the clients at Watches and Wonders were the same as the one that our competitors got and that you reported."

Richemont won't report for another month, but I expect something similar. The lower end of their portfolio (Montblanc and Baume et Mercier mostly), but their generally higher end portfolio will probably do okay.

And then there's Swatch, truly my favorite whipping boy.

Remember how the 500-3000 CHF segment is taking it in the chin right now? What brands do you suppose play predominantly in that segment?

Off the top of my head, Longines, Rado, Tissot, Union Glashutte, Certina, Mido, Hamilton. The list goes on.

Remind me again who owns those brands?

Ah that's right.

Swatch, being the enlightened and shareholder friendly company that they are, only publishes results at the half year, so we're not going to hear a peep out of them until July.

But when they do...expect fireworks.

Is there a the bright side?

https://youtu.be/kO3Rd6U4CjE?si=tK6ftiXxx65uRtNl

If you can stomach the economic uncertainty, it's a pretty great time to buy a watch, particularly in that mid tier bucket.

I occasionally have my eyes on a Longines Zulu Time and its been fascinating seeing the prices plunge. You can get a brand new 39mm version for 20% off MSRP. You can get a brand new 42mm version for 30% off.

For even higher price point pieces like Rolexes, availability is rising. Two days ago, I got a call for an Everose GMT Master II, a watch I hadn't even expressed interest in. If you pay a cent more than retail, you're a psychopath.

Keep those wallets ready. The next couple of years are going to be fun.

Fin.

@SpecKTator @celinesimon @Aurelian @AllTheWatches s @Fieldwalker @valleykilmers @Mr.Dee.Bater @UnholiestJedi @Porthole @Sinnguy

My Zulu Spirit was 40% off with stickers and honestly, I still overpaid.

Insightful writeup as always and I think the worst is yet to come. Q2 market wise has been in the toilet and for many, when they see savings go down, so does spending.

Throw in the fact expenses across the board are up, parents in the US are caught in an arms races with youth sports and activities because hey, if little Johnny Football doesn't take lessons all year around (and subsequently quit when puberty strikes) how will they keep up? I joke, but it is another thing so many people are spending more on post covid. Far less money for watches and cars. Heck, look at mass secondary car prices not named Porsche.

People spent years over paying and it is catching up. Oh, and there is that whole "It is expensive to borrow" thing.

It speaks to what many of us say, buying well is as, if not more, important than selling well, especially with luxury goods. I am a "blood on the streets" type of person, so I look forward to paying $8K for a Moser soon. :-)

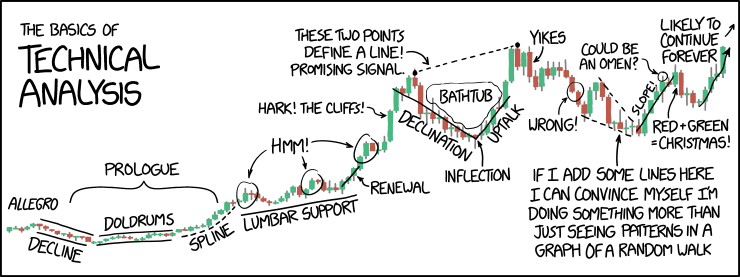

That first chart looks like my retirement accounts 📉😭

As someone who’s just started wading into the pool, I’m not entirely sad that these big companies are feeling pain. Do you think this is just a regular correction or more indicative of a a greater trend?

OMG!!! I'm sooooo excited for the buying opportunities ahead!!!

Actually, that's not really true. Weirdly, I'm pretty content with my collection. It's like I have the watch collecting equivalent of ED - is there a little blue pill I can take to fix that?

I am amazed that shipments to the U.S. declined, though. Bitcoin is at an all-time high. The S&P 500 gained 24% in 2023. Sure, inflation is still running hot, but unemployment is at 3.8%. I mean, you couldn't ask for a better economy! Why would U.S. luxury buyers be pulling back?

On top of that, the middle is getting squeezed, but over time, there are fewer and fewer people in the middle - and, no, they're not becoming poor! The poor are migrating to the middle, and the middle is migrating to the top!

Given how rich Americans are becoming, I would imagine we could continue to sustain luxury watch imports!

Ah crap, just when I stopped looking a resellers and grey market sites.

My Zulu Spirit was 40% off with stickers and honestly, I still overpaid.

Insightful writeup as always and I think the worst is yet to come. Q2 market wise has been in the toilet and for many, when they see savings go down, so does spending.

Throw in the fact expenses across the board are up, parents in the US are caught in an arms races with youth sports and activities because hey, if little Johnny Football doesn't take lessons all year around (and subsequently quit when puberty strikes) how will they keep up? I joke, but it is another thing so many people are spending more on post covid. Far less money for watches and cars. Heck, look at mass secondary car prices not named Porsche.

People spent years over paying and it is catching up. Oh, and there is that whole "It is expensive to borrow" thing.

It speaks to what many of us say, buying well is as, if not more, important than selling well, especially with luxury goods. I am a "blood on the streets" type of person, so I look forward to paying $8K for a Moser soon. :-)

Where all my Benjamin Graham groupies at?!?!!

Given the cost of watches has risen so significantly over the past decade, increasingly I view the decision to buy as individual financial decision. Not an investment decision, mind you, but like buying a car or a vacation home. You're actually have to consider things like borrowing costs.

That's said, we are in complete agreement. There will be many opportunities in the coming years to buy watches at 40, 50 or 60% discounts to retail. The worst is yet to come but also the best opportunities.

Here's to that 8K Moser!

Where all my Benjamin Graham groupies at?!?!!

Given the cost of watches has risen so significantly over the past decade, increasingly I view the decision to buy as individual financial decision. Not an investment decision, mind you, but like buying a car or a vacation home. You're actually have to consider things like borrowing costs.

That's said, we are in complete agreement. There will be many opportunities in the coming years to buy watches at 40, 50 or 60% discounts to retail. The worst is yet to come but also the best opportunities.

Here's to that 8K Moser!

Absolutely agree on all fronts! Like cars, some expensive watches will continue to rise. People will lots of money do not usually feel the pinch like others.

That first chart looks like my retirement accounts 📉😭

As someone who’s just started wading into the pool, I’m not entirely sad that these big companies are feeling pain. Do you think this is just a regular correction or more indicative of a a greater trend?

Watches are a fashion item and fashion items are inherently cyclical. In the past 3 to 5 years, we're an upcycle. We're about to test what a down cycle looks like.

I think there was a narrative among self-interested parties ***cough *** hodinkee but suggested that watches had permanently ascended into this permanent necessary fashion item. V this of course was an incredibly self-serving narrative.

I'm curious to see just how much the brands overproduced and if we start hearing stories about the brand owners beginning to buyback and destroy stock.

My gut tells me that this is a normal correction but a deep one.

OMG!!! I'm sooooo excited for the buying opportunities ahead!!!

Actually, that's not really true. Weirdly, I'm pretty content with my collection. It's like I have the watch collecting equivalent of ED - is there a little blue pill I can take to fix that?

I am amazed that shipments to the U.S. declined, though. Bitcoin is at an all-time high. The S&P 500 gained 24% in 2023. Sure, inflation is still running hot, but unemployment is at 3.8%. I mean, you couldn't ask for a better economy! Why would U.S. luxury buyers be pulling back?

On top of that, the middle is getting squeezed, but over time, there are fewer and fewer people in the middle - and, no, they're not becoming poor! The poor are migrating to the middle, and the middle is migrating to the top!

Given how rich Americans are becoming, I would imagine we could continue to sustain luxury watch imports!

I think the decline Us shipments can probably be explained by some combo of Easter seasonality and too much inventory at ADs resulting in lower incremental buys. Last years figures were at a very high level already so there's probably some tuning necessary.

That said, pricing is generally determined by incremental demand versus supply....and if demand steps off the highs and supply is still at record levels.....

Ah crap, just when I stopped looking a resellers and grey market sites.

You could always start again 😂😂😂

Seriously though, it's a gift if you're happy with your collection regardless of the broader market trend. I wish I was there!

Watches are a fashion item and fashion items are inherently cyclical. In the past 3 to 5 years, we're an upcycle. We're about to test what a down cycle looks like.

I think there was a narrative among self-interested parties ***cough *** hodinkee but suggested that watches had permanently ascended into this permanent necessary fashion item. V this of course was an incredibly self-serving narrative.

I'm curious to see just how much the brands overproduced and if we start hearing stories about the brand owners beginning to buyback and destroy stock.

My gut tells me that this is a normal correction but a deep one.

I’m generally a positive person, but I am not certain many of the mid price/entry conglomerate brands will be around in 3-5 years.

Watches are a fashion item and fashion items are inherently cyclical. In the past 3 to 5 years, we're an upcycle. We're about to test what a down cycle looks like.

I think there was a narrative among self-interested parties ***cough *** hodinkee but suggested that watches had permanently ascended into this permanent necessary fashion item. V this of course was an incredibly self-serving narrative.

I'm curious to see just how much the brands overproduced and if we start hearing stories about the brand owners beginning to buyback and destroy stock.

My gut tells me that this is a normal correction but a deep one.

I guess it’s a good thing I got the watches I wanted in Japan then. Sounds like a great time to travel some more. Great time to find some deals.

I’m generally a positive person, but I am not certain many of the mid price/entry conglomerate brands will be around in 3-5 years.

I think the typical strategy is putting them in stasis and then doing a relaunch in a couple years. I can't recall if a conglomerate has done kt recently though (except Tudor in the US of course.).

We will see though. Baume et Mercier feels like a likely victim.

I guess it’s a good thing I got the watches I wanted in Japan then. Sounds like a great time to travel some more. Great time to find some deals.

Hell yes! You nailed it. Strong USD, weaker non US economies and a bit of travel mean some wicked deals.

We’re witnessing a slow-motion car crash. Currency and interest rate hedging can only do so much to stem the systemic pain for the Swiss giants. I’m more interested in the collateral damage. Small independents and micros have ridden their coattails a bit. I’d like to see a price correction at that level.

Lovely insight!

Aside from China's bad economic form and its consequences, are we still in the wake of the covid-era overly optimistic outlook in the luxury goods sector even in the west? How long do you reckon before the industry re-adjusts and align its expectstions more inline with reality and get over the artifically inflated watch market during covid?

I figure you'll know it's bottoming out when you have Richemont and Swatch buying back stocks.

But the bullwhip thesis suggests that as long as there is significant inventory in the channel (i.e. at the store level), then you're going to have some bad export numbers. I'm pretty sure there is a LOT of inventory at the store level

It’s interesting that lvmh lost 2% on sales while zenith is going all it can to ramp up production to meet an increased demand. I suppose there will always be outliers. I know zenith is a cult favorite with watch nerds like us, but makes me wonder if the brand is gaining momentum with the general public. It seems to really have some wind at its back from years of interesting releases of late.

I don't think you can extrapolate anything broader from Zenith. They make 25k watches a year at a middle luxury price range. Omega makes half a million? Tag makes 400k ish.

It's just not a big impact

I see your point. But with a 5 delay power reserve and finish that is on par with Tudor, AND having owned both I would say the Oris is worth it.

I forgot about that 5 day PR. It's definitely a point in the Oris's favor.

I think my general point is less that the Oris is some terrible value (it isn't) but they competition in the segment is hellish. I'd feel very uncomfortable if my direct competitors (within a couple hundred dollars) were Omega and Tudor.

Apathy - I think that’s another silent problem… I won’t go into massive detail, brand by brand, but some of them need to pull their finger out.

Watch nerds tend to over index their own beliefs onto the broader market.

To spin your concern in a different way, how many normies bought their first watch over the past 3 years and won't feel the need for the newest features for years?

Watch nerds tend to over index their own beliefs onto the broader market.

To spin your concern in a different way, how many normies bought their first watch over the past 3 years and won't feel the need for the newest features for years?

True - again, apathy, or who genuinely gives a s**t? Matey opposite me with his newish green Oris Aquis isn’t bothered about what Tudor are doing today, or tomorrow, he’s got his watch. My old man has his absolute bangers and isn’t buying much, if at all. He bought a gold jobber recently only because the price of gold has gone up - he likes the watch but he’d sell it for scrap if he could. I only bother about what I can get for £50-£100, I just don’t care anymore, I don’t need another Rolex or Omega, I can pass on a Panerai. I’m going to see Bremont in two weeks, so there is that. I’m lusting after a Thorn atm. None of the brands mentioned are relying on me, nor should they, and I am a vintage whale anyway. I think what is important is keeping things fresh, and a large number of brands are being far too complacent. Others have lost the plot.

Very reasonable and fair take. I largely agree with it. It's a decent time to be a buyer, especially pre-owned. New prices are still wildly inflated. Some brands have overextended on price, Swatch Group to am absurd degree (AD discounts demonstrate this perfectly), likely JLC, and others. You should not buy a single watch at retail outside of Rolex and much cheaper watches that don't typically offer discounts. You shouldn't be paying over retail for anything outside of the most absolute desirable models or brand new releases. That white dialed Speedmaster will be available under retail in a year. Same for that new Tudor GMT.

Watches are not a commodity and I wouldn't extraolate expectations elsewhere on to them.

That said, keep an eye out on the Chinese economy. Signs are starting to point to a return to strong economic growth. Energy/fuel demand (my field) is growing quickly, manufacturing and exports are up massively. It looks like the real estate slowdown may be pretty limited in scope. The US economy is also really strong at the moment, and Japan looks pretty healthy (though their buying power is weak at current exchange rates). Europe is stuck running in place, but it won't matter if the US and China are running at full speed.

Incisively put, especially as to not trying to read through too much on broader demand indicators. It's correlated of course but a soft correlation. Watches are fashion, not barrels of oil, tons of steel or MW usage.

Ok I’m not smart!? So you’re saying I can have a new set of collections for less price !! Ok I’m in!! 🤯🥳

I saw the effects of this. 104 days wait for an OP41 with a blue dial!

And now you don't need to!

I love the analysis!

It's a buyer's market for sure, especially since so many grey/pre-owned retailers stocked up during the highs; now they have plenty of watches to offload.

Buy, people, buy! 😜

It is a mixed bag for micros, but one thing is for sure - we are all marching to our own drum.

Some of our partners have reported a record Q1, others are flat to slightly down. Some have said they are up slightly but have had to increase ad spend about 50-100% to achieve that. Others have done absolutely nothing different from last year but have doubled sales. Many of our factories have reported a 10-15% decrease in order volume last year and are expecting a further 10-15% drop in order volume in 2024.

Many factories in China have doubled down on their sales teams to try to stop the bleeding, but the drop in order volume has come mostly from large Swiss and European brands, not micros, which according to many factories continue to grow. Many of the large Swiss have pulled production out of China and moved it to Thailand, and a select few micros have follow suit - but this started back in 2020 due to China’s zero-Covid policy.

Don’t really know what to make of any of the above yet, but one thing is certain. We are going through turmoil, many will be shaken out but those that survive will come out on the other side much stronger.

Thanks for such a detailed response Wes!

I’m always wondering how long the dependence on China will go on, when under Xi the country has become as awful globally as Russia (no need to list the horrors here)

Moving production elsewhere is safer, but I’m guessing more costly. Must be brutal choices.

Hope Nodus keeps on track and stays strong 💪

You raise good points on the economy. Never mind the inflation, if you owned a home or had equity investments, you are doing fine.

So "Why would U.S. luxury buyers be pulling back?"

They are not. They are only pulling back on luxury watches. Retails sales this month exceeded expectations.

It's what you would expect after a lock down, the substitution effect. "Everyone's going to Taylor Swift concerts." I'm joking but not really.

In broad terms, they are moving along their indifference curve and shifting from buying products to experiences. And by experiences I mean a basket of alternative goods. But mostly experiences. Cuz they were locked down.

Buyers are moving down market, yes, but many are moving out of the market entirely. This will have long term consequences for the Swiss brands, mostly bad I think.

Hmmm .. this seems like a good idea for a video maybe? @SimonB lol

I think it's a phenomenal video topic. You, This Watch That Watch and Pete McConvill are with out a doubt my trusted go to sources for the logical and analytical side of watches. Thank you for challenging me with your thought provoking topics.

I think it's a phenomenal video topic. You, This Watch That Watch and Pete McConvill are with out a doubt my trusted go to sources for the logical and analytical side of watches. Thank you for challenging me with your thought provoking topics.

Well now .. I checked out Peter's channel. I like his take on brand ambassadors. He's actually quoting leading figures in behavioral economics.

Well now .. I checked out Peter's channel. I like his take on brand ambassadors. He's actually quoting leading figures in behavioral economics.

Can you please link your videos here on WatchCrunch. The algorithm is a B

I forgot about that 5 day PR. It's definitely a point in the Oris's favor.

I think my general point is less that the Oris is some terrible value (it isn't) but they competition in the segment is hellish. I'd feel very uncomfortable if my direct competitors (within a couple hundred dollars) were Omega and Tudor.

I certainly agree that if that price point is arguably the toughest place in the market to compete with the most quality other options available. I just happened to believe having owned many other models in this price segment that the Aquis with their proprietary movement certainly holds its own.

I think there’s some degree picking a watch in this price segment comes down to personal taste and style preference. I just happen to really enjoy the design of the aquas as it’s pretty unique in the Watch world for its design and layout. Also, the blue dial is Near H Moser level in beauty

I love the analysis!

It's a buyer's market for sure, especially since so many grey/pre-owned retailers stocked up during the highs; now they have plenty of watches to offload.

Buy, people, buy! 😜

@AllTheWatches has been tempting me with offers he's getting on Mosers!

A man can only take so much!